Are We Staring Down a Recession, Or What?

Soft landing, hard landing, or no landing at all—a look at the possible economic scenarios.

Listen to the brief

Recently, several prominent tech companies announced four and five-digit layoffs, which resulted in big headlines and a scurry of confusion. Is this the recession we've been expecting?

Then, weeks later, when the economy added more than 500K jobs— a far cry from the 100K jobs that were predicted—the confusion was compounded. Wait, can you have a recession when the labor market is this strong?

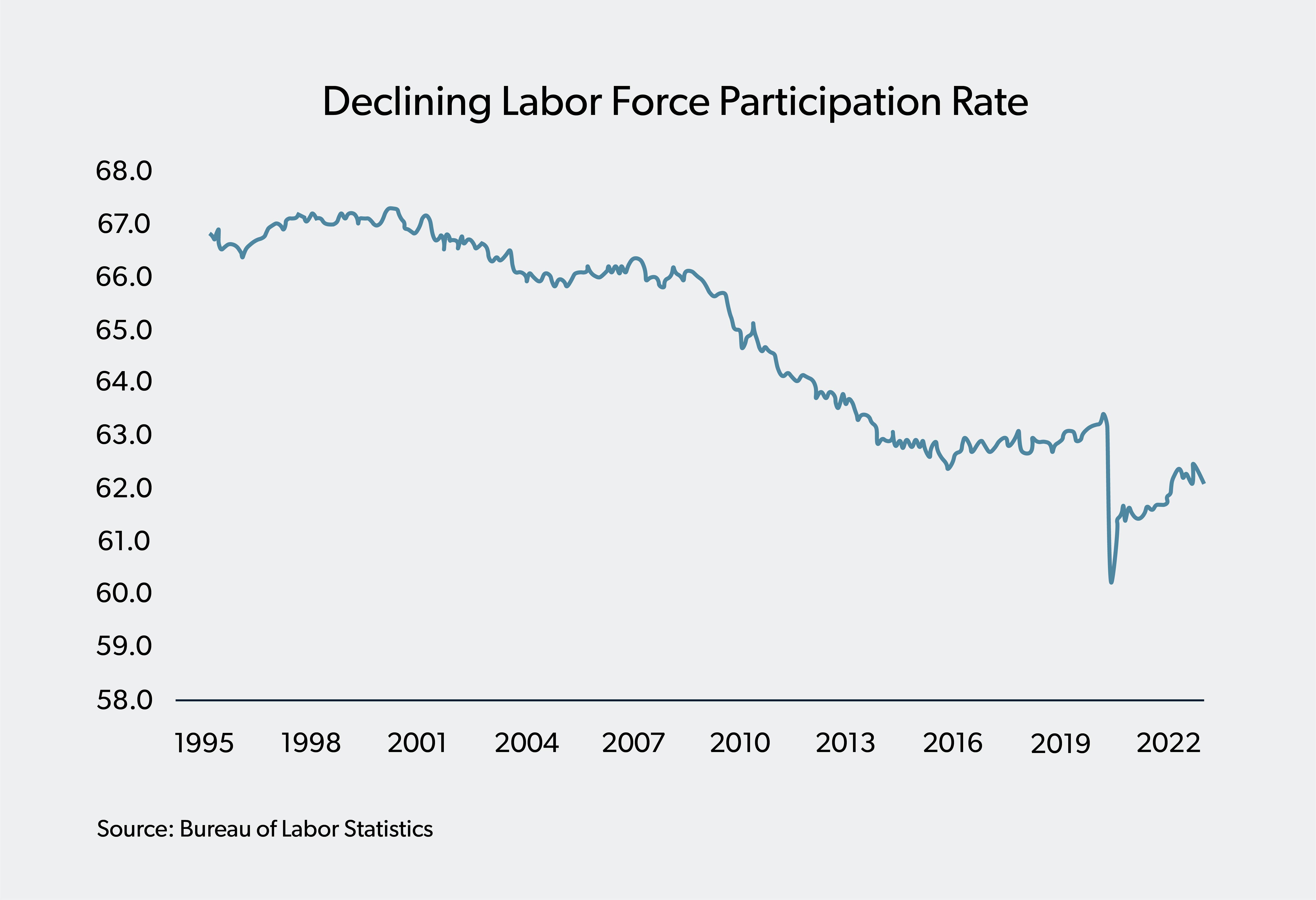

There are a lot of economic factors competing for attention right now and their mixed messages are confusing: low unemployment, rising interest rates, low labor force participation, high inflation. However, to understand what’s currently happening in the economy—and still could happen—these factors can’t be viewed in isolation.

Before we assess the possible outcomes of this strange economy and labor market, let’s revisit the circumstances that helped get us here in the first place.

As pandemic lockdowns eased, the economy heated up quickly. There was high demand for workers and products, but very low supply of both. This caused inflation to soar.

- As we emerged from the pandemic, the economy took off like a rocket. People had money to spend and energy to burn. Between the accumulation of savings and trillions in government stimulus, consumers were eager to purchase, upgrade, improve, invest, and explore. So, companies ramped up hiring.

- Except, neither talent pipelines nor supply chains could keep up with the demand. Companies increased salaries to compete for available talent—a move that was bolstered by crazy-low interest rates, which gave companies a lot more hiring power.

- But salaries weren’t the only thing to increase. Supply chains had dwindled during the pandemic and were unprepared to accommodate the uptick in demand for things like cars and smart phones, patio furniture and housing (including rent). Law of supply and demand meant prices for these goods also increased, though still-low interest rates took the sting out of these inflated sticker prices for consumers.

- Parallel to increases for goods, energy prices also skyrocketed to all-time highs. Higher energy costs result in higher production and transportation costs—and not just for smart phones and lawn furniture, but for groceries too...

- Which meant that the sustained and record-setting wage increases employees were getting wasn’t keeping pace with inflation. For example, for the year ending June 2022, a reported 5.1 percent increase in wages felt like a 3.6 percent loss.

- However, with an extremely tight labor market, companies were still paying high salaries to attract talent, the costs of which were offset to consumers by way of high prices (i.e., inflation).

The Federal Reserve’s interest rate hikes are an attempt to slow inflation by reducing the amount of money people are putting into the economy. The Federal Reserve, a body that sets economic policy in the US, was challenged with the task of reversing the course of inflation without crashing the economy. Their aggressive interest rate hikes were/are an attempt to achieve that goal by weakening a very strong labor market. That’s because as job opportunities shrink, the Fed expects competition for workers to ease and wage growth to slow, which means spending will slow, which means demand will slow, which means, hopefully, inflation will too.

- Except, unemployment, for now, remains low and job openings remain high.

Higher interest impact the labor market because they result in steeper borrowing costs for companies. Steeper borrowing costs mean less growth, less spending, and less hiring.

But what about the layoffs? Large technology companies that over hired during the early days of economic recovery, are feeling the squeeze of higher interest rates and a slowing economy in different ways (e.g., fewer sales, less advertising, steeper borrowing, etc.). Payroll cuts, or layoffs, are a quick cost-cutting measure with immediate results: profits increase, which means stock prices do, too.

For now, the labor market remains strong despite increased layoffs, particularly at tech companies. There are a couple of theories to explain these layoffs, neither of which begin with the letter "R":

- Scaling back after explosive growth. As we've mentioned and illustrate below, several technology companies ramped up hiring between 2018 and 2022 as the world went digital, particularly during the pandemic. The graph below illustrates the rate of growth among tech companies versus the recent rate of cuts. Apple, which showed slower signs of growth between 2018 and 2022, has yet to layoff.

- Layoff contagion. We wrote about this type of phenomenon during The Great Resignation era in describing the high rate of job quits: When one employee leaves, the departure can have a ripple effect on others in the company. In many ways, we may be seeing a similar phenomenon with layoffs. As big companies lay off and stock prices increase as a result, it leaves other CEOs and Boards of Directors to ask, "should we be laying off too?"

However, even with the slight uptick in layoffs, the labor market remains strong. Despite aggressive interest rate hikes, unemployment remains historically low (it's even lower in STEM labor categories) and inflation remains high.

Wages are cooling but are still up, and companies are still increasing prices to recoup salary costs and profits that were cut due to higher interest rates.

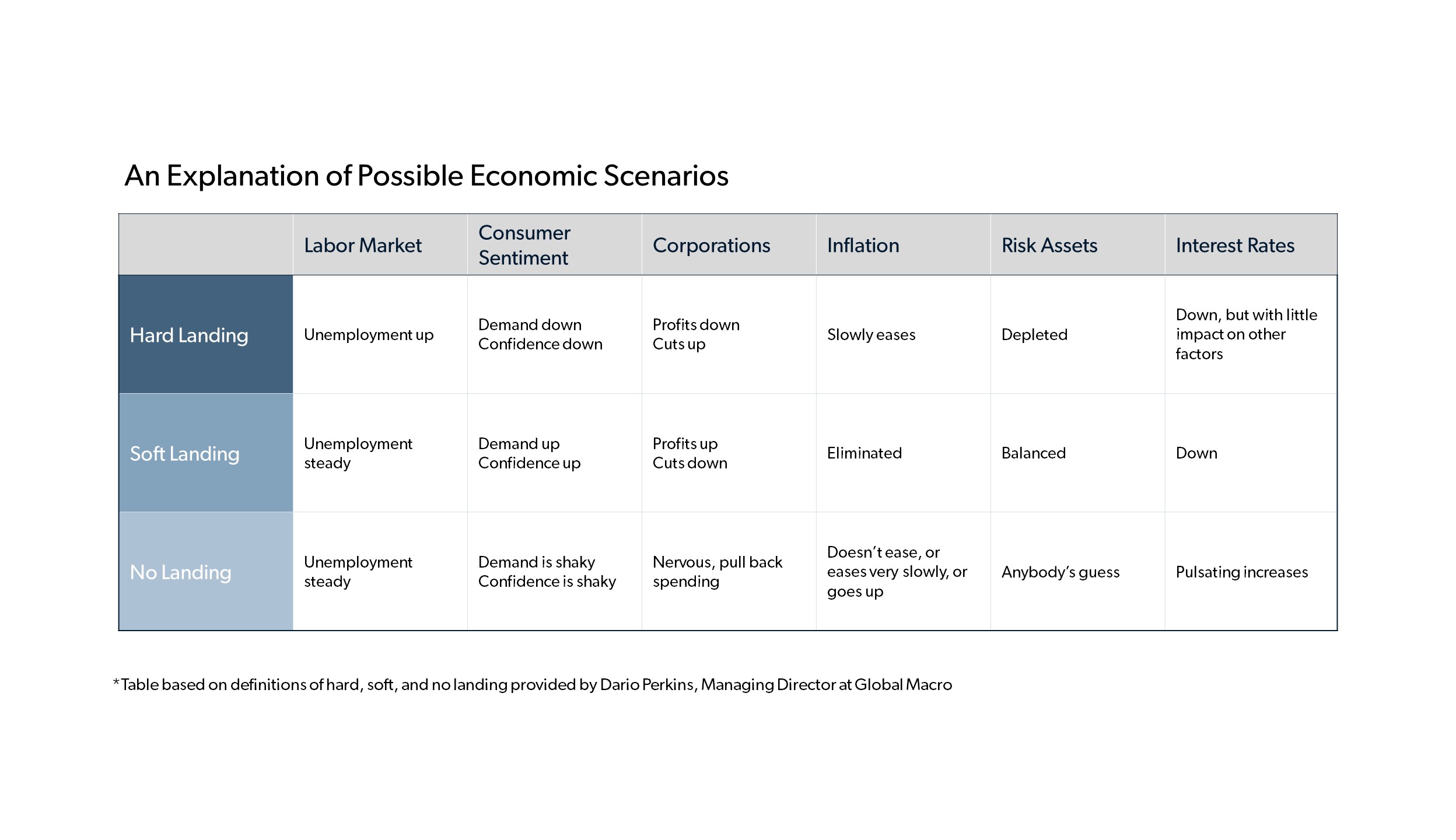

In other words, forecasting the economy has become an explanation and examination of three possible scenarios: Hard Landing, Soft Landing, and No Landing.

So, Which Landing Are We Looking at Right Now?

There continues to be a lot of uncertainty regarding what the future of the economy and labor market will look like in 2023.

To recap:

- Unemployment remains low, despite higher interest rates. In fact, over the last six months of 2022, the unemployment rate never exceeded 3.7%. In January of 2023, it fell even further to 3.4%.

- Labor force participation rates remain below pre-pandemic rates, which was already low. Neither high inflation nor high interest rates are driving people back to the labor force as expected.

- Even in the face of recession fears and announcements of layoffs from the media at the end of 2022 and at the start of 2023, government data continue to consistently report low levels of layoffs and higher levels of voluntary quits, implying that employers in general were not implementing mass layoffs, nor were workers afraid to still consider opportunities outside of their current job.

- Given all this, inflation remains high, despite the pressure of higher interest rates to bring it down, and with inflation running high, the Feds aren't likely to ease interest rates anytime soon...

- Which means the likelihood of a soft landing is fading, but with the labor market still strong, a hard landing doesn't appear imminent either.

- Therefore, it appears we're looking at a no-landing scenario for now.

The labor market and economy will continue to be confusing well into 2023, possibly beyond. But hopefully, with a better understanding of the factors contributing to the various scenarios, companies will be prepared to make the best decisions for their business and their employees.

Afterall, the labor market remains tight and there is still a lot of work to be done.